Making Sense of the Noise

- Nick George, CFP®, ChFC®, CLU®

- Apr 7

- 7 min read

Updated: Sep 27

Happy Monday, everyone. I hope you had a great weekend.

Last week, I shared some thoughts about what we can control when the markets get a little messy, to hopefully ease some of the anxiety that comes with headline whiplash in the stock market. I wanted to let the dust settle a bit before diving into what's actually driving this volatility...and the bigger question many might be asking: where the heck do we go from here and how do I make sense of all this?

Before we get into it, let me say this. It would be a disservice to you and my role as a financial planner if I didn't try to stay neutral in my political stance. This isn't about what I believe politically. It's about how to think clearly and make informed decisions in a time that feels confusing. These are simply my thoughts and I would be the first to tell you that I do not have all (or any) of the answers.

So here it is. Let's discuss the mess, the meaning & the mindset.

What Exactly Was "Liberation Day"?

On April 2, President Trump declared it "Liberation Day" which is quite the dramatic phrase...but in true Trump fashion lol (it's still okay to chuckle). The word liberation comes from the Latin liberatio, meaning "to set free." This word may bring a few major moments in history to mind (WWII, emancipation of enslaved Americans, etc). That said, this isn't a history class and we are not comparing today's economic events to those major moments. But clearly, the intention was to frame this day as a symbolic turning point with an attempt to reclaim control.

The message?

"We're done playing by the rules of globalism, it's time to take America back."

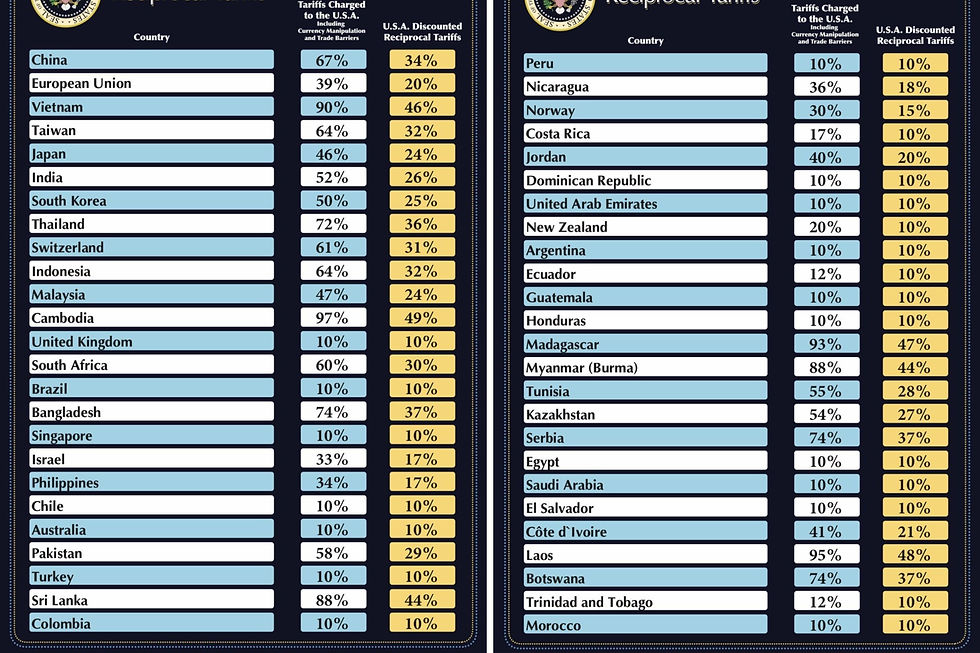

And how? With tariffs.

Tariffs as a Tool of "Freedom"

So, what exactly are we being set free from? In this narrative & according to Trump's team, they're meant to:

Free the U.S. from "unfair" trade deals

Reduce the reliance on cheap foreign labor

Reclaim manufacturing and supply chain independence

Punish countries like China that "take advantage" of America economically

It does seem to revolve more around economic defiance than anything else, like a reset button. Even saying that has me thinking "boy...I hope he knows what he's doing." And the problem is, the markets do not think this is a good idea, and didn't exactly throw a celebration. Furthermore, many economists are increasingly worried that Trump is trying to "crash the economy" for one reason or another that I will not get into. Do I believe this? No...not really.

The Art of the Deal

Let's talk about negotiation, because in my opinion, that is likely what this is. And I could be wrong.

If you have ever watched Shark Tank, you know how it works:

One side makes a high initial ask,

The other counters low,

And ideally, both sides land somewhere in the middle. (a little simplified, but you get the point)

That first number? It's called an anchor, and it sets the entire tone of the negotiation. It's a psychological "trick" where studies show that people will unconsciously move closer to that number, even if it's outrageous.

This is classic Trump. Whether in real estate or politics, he's always led with an extreme position which we have seen before. It's not necessarily because it's where he wants to end up, but the starting point.

"Here's the new tariff structure...your move."

Now, China has had some experience in the past with Trump's tendencies and fired back with a 34% tariff on U.S. goods. That’s not small. It signals that if this escalates, we could be headed for another round of tit-for-tat trade tensions, like we saw in 2018. Fun stuff.

Federal Reserve Chair Jerome Powell responded cautiously, signaling concern about how these tariffs might affect inflation and growth. And Trump, unsurprisingly, pushed back and accused the Fed of “playing politics.” Shocker.

Now you’ve got political tension, economic tension, and media noise all piling into one big volatility soup. Yummy..

Does this unsettle the markets? Absolutely. But if it's truly a negotiation tactic, and nobody really knows....but there's a chance the numbers get dialed back. And if they do...

Markets Could Rally Just as Fast as They Dropped

Markets tend to react to headlines before facts. Right now, they’re pricing in worst-case scenarios. But if there's a reversal or softening of the proposed tariffs or even just the suggestion of a deal, we could see a sharp rebound.

Think of it like a compressed spring: the further you push it down, the more energy it builds on the way back up. We've seen this before, many times. Markets often overcorrect in both directions. They fall too far on bad news and then bounce too high on relief. That’s why the moves feel so dramatic right now. Now, this is just theory, and I need to be careful here as I am not saying this is what will happen. The markets could continue compressing downward for some time. I really don't know if or when a rebound is likely. My crystal ball got lost in the mail along with everyone else's. But we saw this happen with Covid, if you remember.

So...do Tariffs Even Work?

Historically, tariffs have had a pretty poor track record. Research from the Peterson Institute for International Economics and others consistently shows that tariffs:

Increase consumer prices

Hurt domestic companies that rely on imports

Rarely achieve long-term job growth in targeted industries

It’s like trying to fix a leaky faucet with a hammer. You might slow the drip, but you’ll likely break something else in the process.

And here's a key point some might forget: Manufacturing is hard to build...and even harder to move. Setting up a supply chain takes years. Factory locations, labor contracts, compliance, logistics, it’s like assembling a jigsaw puzzle blindfolded. Once it's set, companies aren't eager to rip it all up because of a headline. Talk about lost sleep.

That's why the idea of overnight reshoring is mostly fantasy.

Any Silver Linings? Maybe a Few

The whole situation is confusing and a bit chaotic. Everyone has an opinion and thinks they're an expert on tariffs. There are doomsdayers and people who think this is the best thing to happen. Oy vey. But here are a few small things that have happened:

Gas prices have come down, and interest rates have dropped, which I guess is a little positive. Does cheaper gas make up for someone losing their job? Of course not. But if mortgage rates come down and home prices soften... and you are in your 30s looking for a house and start a family, that could be a win. Again, as long as you still have your job. I try to find positive bubbles where they can be found, I try to keep optimism at the forefront, for better or worse.

Where The Heck Do We Go From Here?

I wish I had a clear answer...but I guess here is what I do know:

Markets overreact. They also recover.

Headlines are continued noise. Your financial plan shouldn't change based on headlines.

None of us, not even most people in D.C. really know what is next. I don't think anyway.

When the market moves, in either direction, try to remember:

"Nothing is ever as good or as bad as it seems."

So for now, keep doing the boring stuff that works. Cook dinner, watch that TV show, spend time with the kiddos, control your savings, stay invested, and keep perspective.

We have been through worse, we will get through this, too. Together.

Have a great week! References listed below.

It’s easy to feel stuck with money. It's harder to have clarity and a plan you trust. If that feels like something you've been missing, let's talk about it.

Nick George CFP®, ChFC®, CLU®

Founder | CERTIFIED FINANCIAL PLANNER® Practitioner

ClearMind Capital

The information presented in this article is for informational purposes and should not be intended as tax, accounting or legal advice, nor is it an offer or solicitation to buy or sell, or as an endorsement of any company, security, fund, or other offering. Please consult your legal, tax, or accounting professional regarding your specific situation. Investments involve risk and have the potential for complete loss. It should not be assumed that any recommendations made will necessarily be profitable.

The opinions expressed in any commentary posted on this site are solely those of the individual author and do not necessarily reflect the views or opinions of ClearMind Capital, LLC. These opinions are based on information available at the time of posting and are subject to change without notice. ClearMind Capital, LLC, does not commit to updating any posted positions or commentary to reflect subsequent developments. While the information and reasoning used to form these opinions are believed to be from reliable sources, ClearMind Capital, LLC, does not verify this information, and no guarantee is provided regarding its accuracy, completeness, or validity. ClearMind Capital, LLC, disclaims any and all liability for actions taken or not taken based on the content of this site. No warranty, express or implied, is given in connection with the content provided.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

References & Further Reading

Tariffs and Their Economic Impact

Peterson Institute for International Economics.“The Costs of Trump’s Trade War.”https://www.piie.com

Tariffs and Historical Outcomes

Ben Carlson, A Wealth of Common Sense.“What Can History Tell Us About Tariffs?”https://awealthofcommonsense.com

Federal Reserve Comments on Trade Policy Uncertainty

Federal Reserve Chair Jerome Powell – Press Conference Transcript (April 2025).Available via federalreserve.gov

China’s Retaliatory Tariffs Announcement (April 2025)

CNBC or Reuters News Coverage on April 3, 2025.

The Psychology of Negotiation & Anchoring

Kahneman, Daniel. Thinking, Fast and Slow

Harvard Law School: “Anchoring in Negotiation”https://www.pon.harvard.edu

Supply Chain & Reshoring Challenges

McKinsey & Company.“The Complicated Reality of Reshoring Manufacturing.”https://www.mckinsey.com

Gas Prices and Mortgage Rate Trends (April 2025)

U.S. Energy Information Administration (EIA)[https://www.eia.gov]

Freddie Mac – Mortgage Rate Survey [https://www.freddiemac.com/pmms]

Comments